Key points

- Software company Data Action engaged us to redesign the digital customer onboarding experience for two of their clients, Bank Australia and P&N Bank.

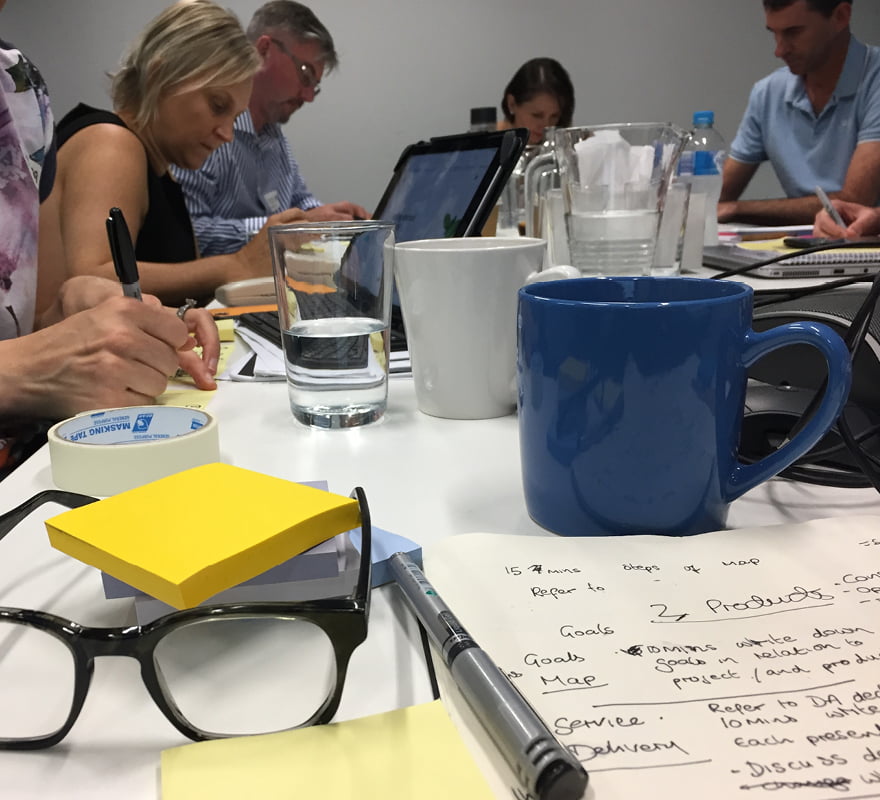

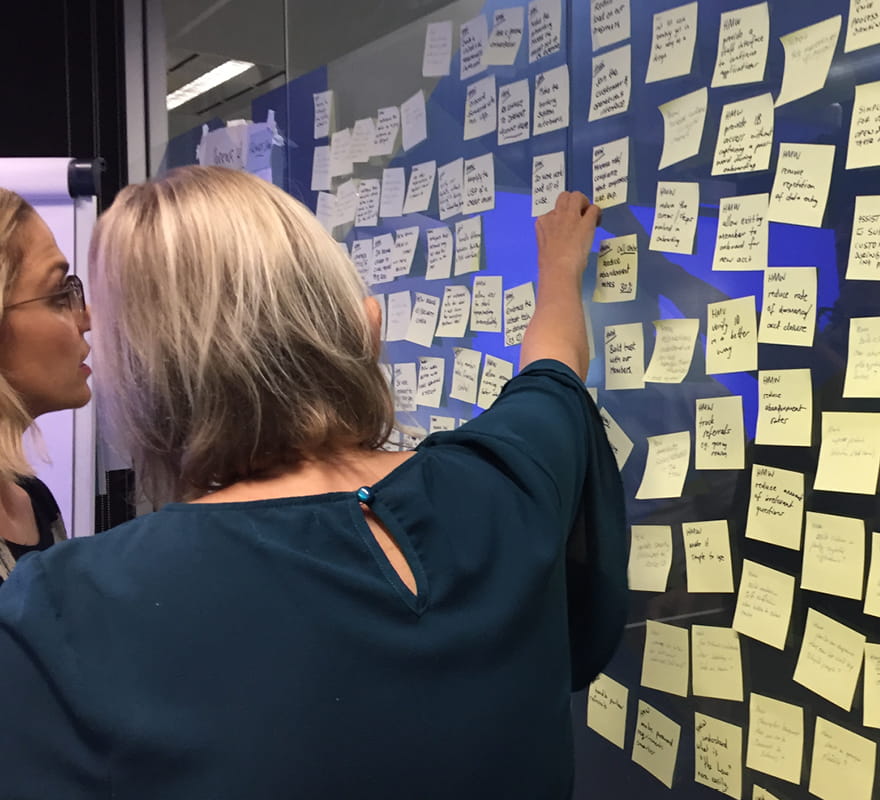

- We ran a series of Design Programs with senior stakeholders and conducted rapid prototyping, plus worked with Data Action’s engineering team to map the customer journey.

- We then set up testing environments with prototypes for credit union members and worked with Data Action’s team to design and build a white-label product.

- The project was successfully launched within scope and budget and, since launch, there’s been a 25% increase in the conversation rate since the launch of the new initiative.

.

Their brief to us

Data Action is a technology company based in South Australia who provide digital banking and core banking solutions for many Australian mutual banks and credit unions. They engaged us to reimagine the ‘Bank of the Future’, starting with overhauling the existing customer onboarding experience for two of their credit union clients, Bank Australia and P&N Bank. Data Action’s goals were to improve the experience for new members; increase the conversation rate of new account holders; use the project as a benchmark to redefine their product delivery for other future service clients.

What we did

We ran a Design Program with senior stakeholders, during which we consolidated existing assets to conduct rapid prototyping. Next, we worked with Data Action’s engineering team and stakeholders to outline the existing and future state end-to-end. We then matched customer actions to related operational processes.

We used these insights to create a series of prototypes at various levels of fidelity, to be tested with members in-branch at Bank Australia and P&N Bank. Once we’d mapped out the experience, we worked with the team to design a white-label product that could be adapted to each credit union’s style guide, and be easily incorporated into their digital stack.

We also designed and implemented a measurement scorecard for the onboarding product, as well as a consolidated dashboard in Google Data Studio so Data Action could monitor their clients’ performance.

The Result

The project was successfully launched within scope and budget for both Bank Australia and P&N Bank. Our agile way of working meant that Data Action’s project services team were able to work efficiently in two-week sprints alongside client stakeholders, and this method has since been scaled and introduced to other projects and financial institutions that are connected to Data Action.